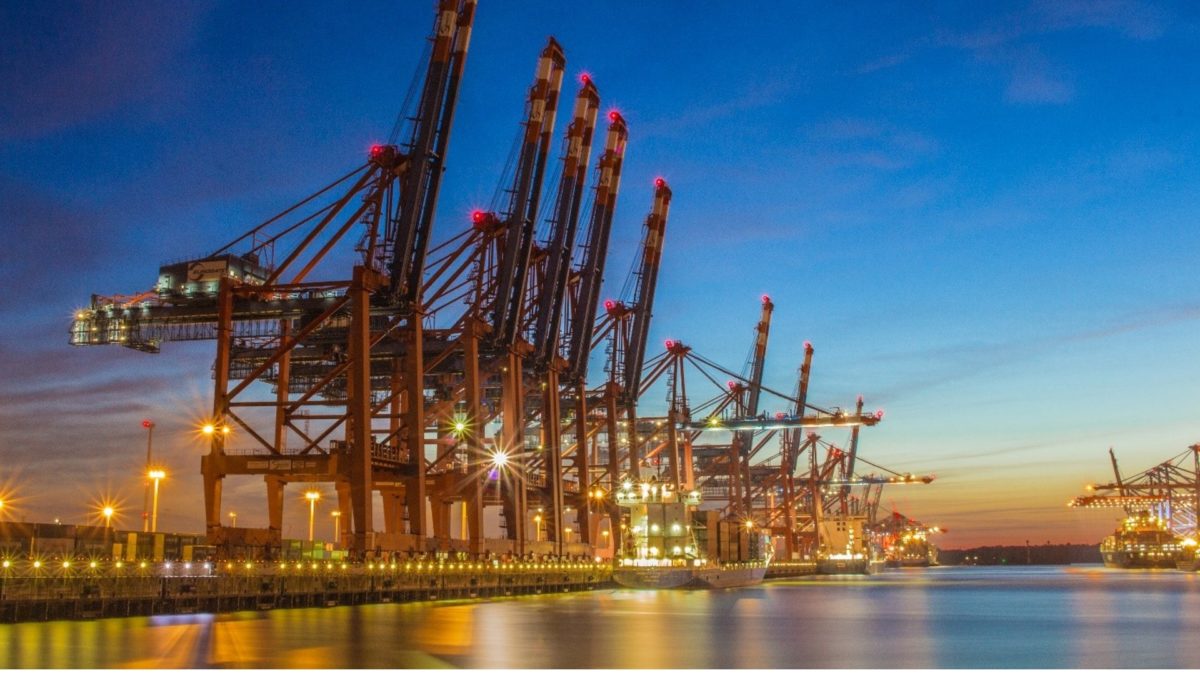

Ports are one of the key players in the green maritime shift. Ports emissions constitutes other sources in addition to emissions from the vessels laying a long side the key. It is potentially a huge effect of port transition financing. It is more and more evident that the ports will be instrumental for this process.

Common for all alternatives fuels is that they will require more frequent bunkering and that it will also require a much more diverse and granular infrastructure at shore. In addition, more traditional (energy)ports (import/export of oil/gas/coal) will gradually need to change their activities as these products are phased out.

Traditional green financing has generally focused on direct environmental investments such as shore power and alternative fuels. The more comprehensive transitions based on the more long-term and overall investments have traditionally had less focus. Such transitions will need to be supported by a broader specter of investments, investments that not necessary only are related to the environment and climate, but also will facilitate more general transitions following the changes in the industry.

KLP is the overseeing partner for the project. Additional partners are listed to the right. Additional contributors to the pilot project is: Port of Tromsø and Port of Hammerfest.

Goal of pilot project

With this pilot, KLP and its partners aim to propose a framework for transition financing of ports and establish the basis for increased green investments in ports, including the criteria that must be met to qualify for such transition financing.

- The goal for the pilot is to develop a framework that can be used by all relevant finance institutions.

- The framework shall form a template that contributes to give a reference for the criteria for future financing.

Status

The pilot commenced in February 2022. The initial phase of the pilot involved studying related previous pilots to connect and build upon the results achieved in those.

A preliminary framework was presented at the Norwegian Ports Seminar on September 8, 2022. The main objective was clarified: transitioning from current green object-based financing (a car/building/charging station) to green corporate financing, provided that specific KPIs are met for the respective company. Assessing the current situation and setting targets until 2050 were central to this.

An important contribution from the pilot is a model that forms the basis for a concrete emissions account. The model is based on experiences from Kristiansand Port. Subsequently, it will be up to the lending institution to determine the conditions, including the “green interest rate.”

The pilot study concluded in April 2023. The pilot has delivered a reward-based system for green corporate financing, provided that specified KPIs are achieved for the company.

Next Steps

KLP takes the framework into customer dialog. The framework can be used by ports and all financial players.

Les mer

- The results of the pilot were presented in an open mini-seminar in April 2023.